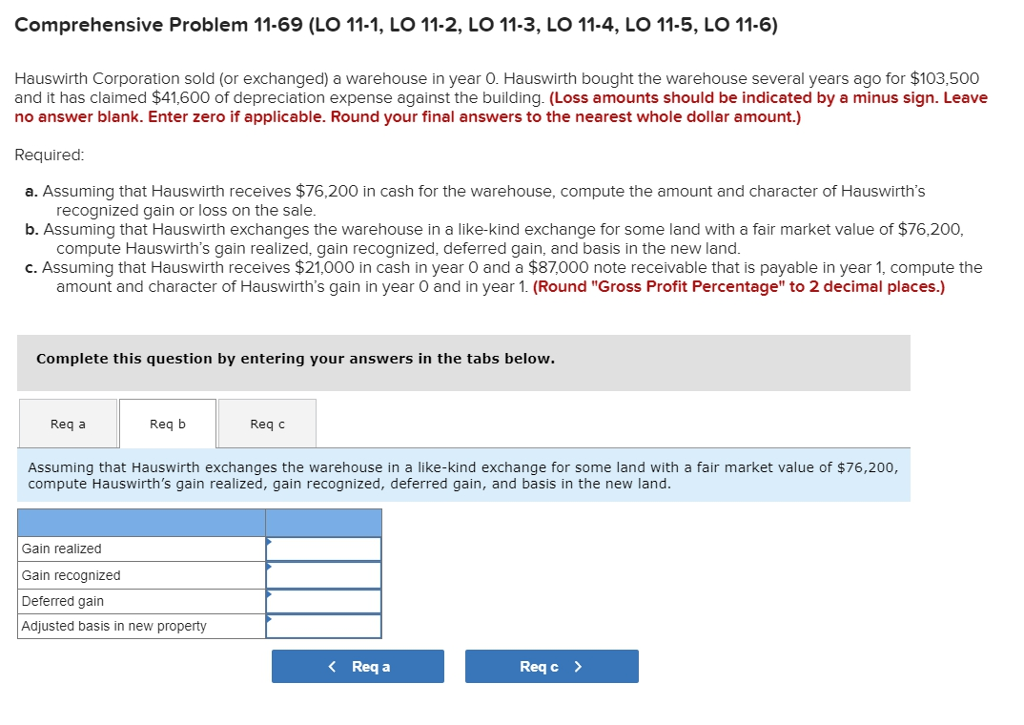

While capital gains tax rates are currently at historical lows tax rules require you to recapture the portion of the gain on the sale that relates to allowable depreciation over the period the asset was held.

1031 exchange land for building depreciation.

Especially when it comes to a 1031 exchange a tool used by investment property owners to defer capital gains taxes.

Real estate that has been held and depreciated over an extended period of time may be subject to significant depreciation recapture income tax liabilities and may be a big reason you decide to participate in a 1031 exchange.

In other words if you sold your old property for 100 000 and bought your new property for the same your basis on the new property would be the same.

The problem comes in when non depreciable property such as land is acquired.

In that situation the exchanger will be unable to defer the depreciation and will be required to recapture the depreciation.

Section 1250 property depreciable real property.

A 1031 exchange can help you avoid capital gains and depreciation recapture taxes but it adds another layer of complication to the depreciation process.

Section 1031 requires that the property being exchanged and received be of a like kind and must be held either for investment or for productive use in the taxpayer s trade or business.

So here s a quick guide to help you.

If the seller in the exchange receives nonqualifying property boot such as cash the taxpayer must recognize gain but not loss on the boot received.

The basic concept of a 1031 exchange is that the basis of your old property rolls over to your new property.

1031 exchange depreciation recapture depreciation recapture is a significant factor in participating in a like kind exchange.

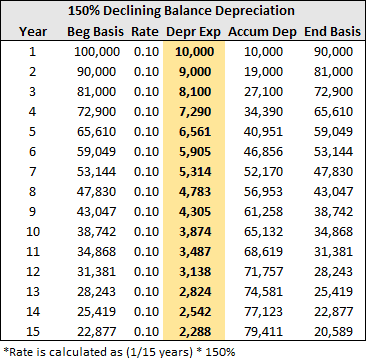

800 795 0769 www 1031 us to develop the replacement property depreciation schedules the temporary regulations split the new total basis of the replacement property between the exchanged basis and the excess basis the exchanged basis is the remaining basis carried over from the relinquished property.

Nonetheless a 1031 exchange can still be a powerful tax strategy even when depreciation must be recaptured.

In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

It is only for business or investment property.

The term which gets its name from irs code section 1031 is bandied.

/man-working-in-computer-1135595001-31f457ad7db84839938774cea99939e0.jpg)